virginia estimated tax payments due dates 2020

If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date. Under normal circumstances quarterly estimated tax payments for tax year 2020 would have come due april 15 june 15 and september 15 of this year with the final payment due on january 15 2021.

West Virginia Code 16A-9-1d Sales and Use Tax.

. West Virginia Code 16A-9-1 d Sales and Use Tax. 2021 first quarter estimated payments are still due May 1. The due date for certain Virginia income tax payments has been moved to the deadline of June 1 2020.

The due date for filing estimated tax forms and paying estimated taxes has been automatically postponed to July 15 2020. You can pay all of your estimated tax by April 15 2020 or in four equal amounts by the dates shown below. WEST VIRGINIA STATE TAX DEPARTMENT Tax Account Administration Div PO.

Nonresident Withholding Tax Payment. Pay bills or set up a payment plan for all individual and business taxes. Pay all business taxes including sales and use employer withholding corporate income and other miscellaneous taxes.

Estimated income tax payments must be made in full on or before May 1 2020 or in equal installments on or before May 1 2020 June 15 2020 September 15 2020 and January 15 2021. Box 11751 Charleston WV. Payment Voucher 1 by May 1 2020.

28 2020 at 308 PM PDT. 4 rows The first quarter estimated tax payment for 2020 was originally due April 15 2020 and. 54 rows Under normal circumstances quarterly estimated tax payments for tax year 2020 would have.

Make joint estimated tax payments. 54 rows under normal circumstances quarterly estimated tax payments for tax. WEST VIRGINIA ESTIMATED Account ID.

All income tax payments due between April 1 2020 and June 1 2020 including estimated tax payments due. The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. Due to the COVID-19 pandemic the payment deadline was.

Please note a 35 fee may be. VIRGINIA ESTIMATED INCOME TAX PAYMENT VOUCHERS 2022 FOR INDIVIDUALS FORM 760ES Form 760ES Vouchers and Instructions wwwtaxvirginiagov Effective for payments made on and after July 1 2021 individuals must submit all income tax payments electronically if any payment exceeds 2500 or the sum of all payments is expected to exceed 10000. Federal 2020 individual returns are now due May 17.

CHECK ONLY ONE PARTNERSHIP FILING FORM WVPTE-100 S CORPORATION FILING FORM WVPTE-100 Taxable Year End. If you file your 2020 income tax return and pay the balance of tax due in full by March 1 2021 you are not required to make the estimated tax payment that would normally be due on January 15 2021. Individual income taxes Corporate income taxes Fiduciary income taxes and.

Individual returns and 2021 first quarter estimated payments are still due April 15. CST-200CU Sales and Use Tax Return Instructions Import Spreadsheet. If you file your state income tax return and pay the balance of tax due in full by March 1 you are not required to make the estimated tax payment that would normally be due on Jan.

If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. Taxpayers who still owe 2019 income tax as well as estimated tax for 2020 must make two separate payments on or by July 15 2020. June 15 2020 3rd payment.

Individual Income Tax Filing Due Dates. When the last day on which a tax return may be filed or a tax may be paid falls on a Saturday Sunday or legal holiday. If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date you may be liable for an additional charge for.

WWBT - The deadline for Virginias individual income tax payment deadline is June 1. 1546001745 At present Virginia TAX does not support International ACH Transactions IATClick IAT Notice to review the details. Please enter your payment details below.

The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. Monthly and First Quarter. April 15 2020 2nd payment.

One for their 2019 income tax owed and one for their 2020 estimated tax payments. If the due date falls on a Saturday Sunday or holiday you have until the next business day to file with no penalty. Returns are due the 15th day of the 4th month after the close of your fiscal year.

Please note a 35 fee may be. Typically most people must file their tax return by May 1. The District of Columbia has not moved its individual filing deadline.

Please enter your payment details below. These individuals can take credit only for the estimated tax payments that he or she made. Pursuant to Notice 2020-18 PDF the due date for your first estimated tax payment was automatically postponed from April 15 2020 to July 15 2020.

March 20 2020 IMPORTANT INFORMATION REGARDING VIRGINIAS INCOME TAX PAYMENT DEADLINES INCOME TAX PAYMENT EXTENSION AND PENALTY WAIVER IN RESPONSE TO THE COVID-19 CRISIS On March 19 2020 Governor Ralph Northam requested that the Department of Taxation extend the due date for certain Virginia income tax payments to. Likewise pursuant to Notice 2020-23 the due date for your second estimated tax payment was automatically postponed from June 15 2020 to July 15 2020. Virginia Governor Ralph Northam announced that while filing deadlines remain the same the due date for payment of individual and corporate income tax will now be June 1 2020.

Any estimated income tax payments that are required to be paid to the Department during the April 1 2020 to June 1 2020 period. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. If you file Virginia estimated payments keep an eye on May 1.

1546001745 At present Virginia TAX does not support International ACH Transactions IATClick IAT Notice to review the details. Make tax due estimated tax and extension payments. Virginia estimated tax payments due dates 2020.

However the Virginia extension to pay while penalty-free is not interest-free.

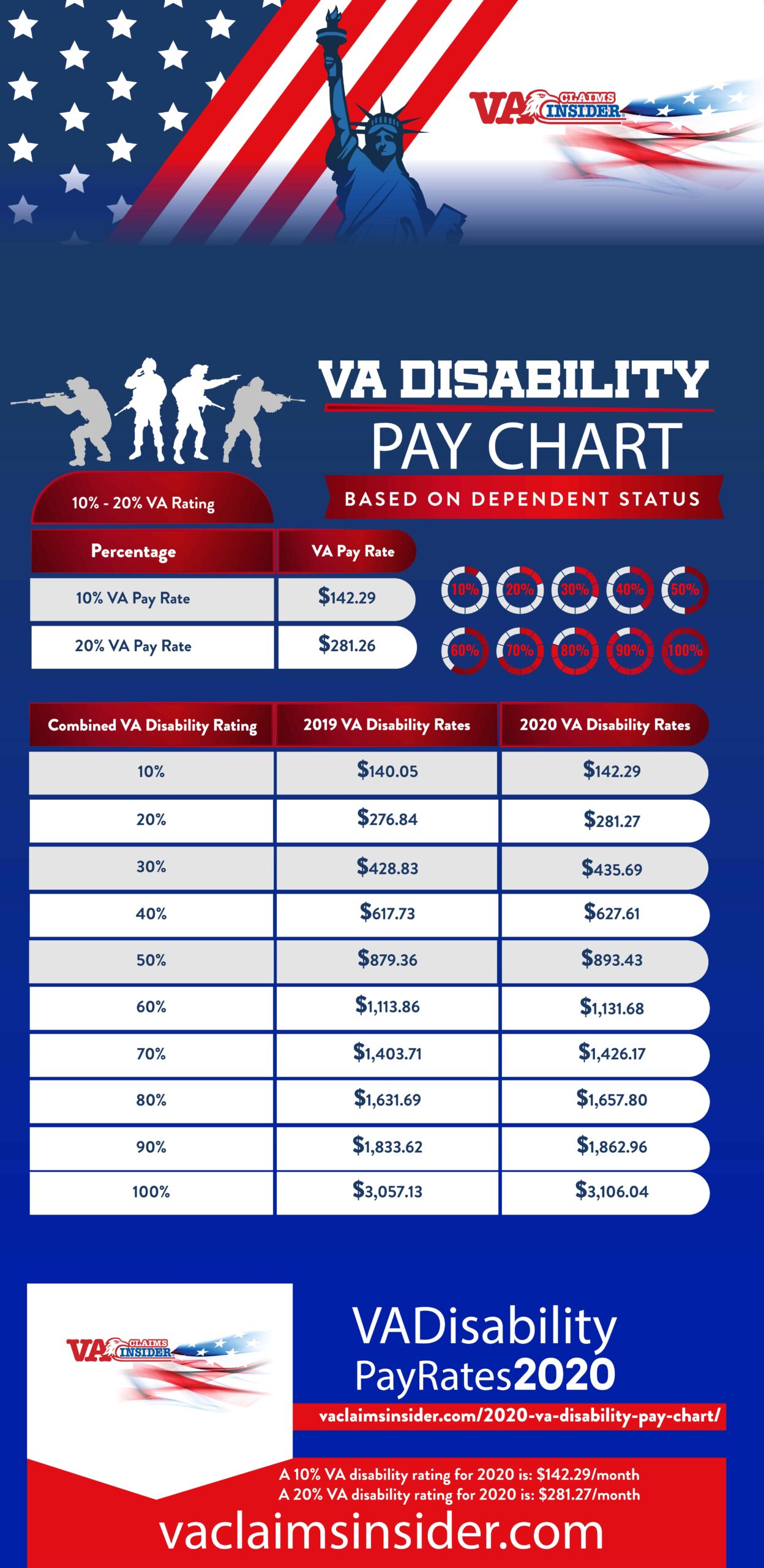

2021 Va Disability Rates And Compensation Hill Ponton P A

Virginia State Taxes 2022 Tax Season Forbes Advisor

Georges Excel Mortgage Calculator Pro V4 0 Free Online Mortgage Calculator Latest Va Home Lo Mortgage Calculator Tools Mortgage Payment Calculator Mortgage

2022 Va Disability Rates Pay Chart

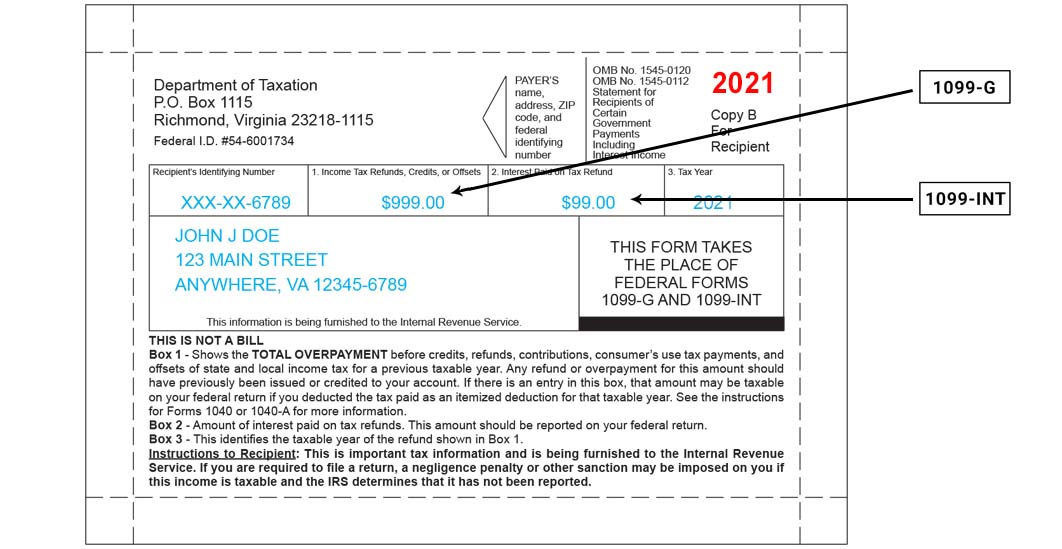

1099 G 1099 Ints Now Available Virginia Tax

Prepare And E File Your 2021 2022 West Virginia Tax Return

Virginia State Tax Information Support

Virginia S Individual Income Tax Filing Extension Deadline For 2020 Taxes Is Nov 17 2021 Virginia Tax

Virginia Tax Forms 2021 Printable State Va 760 Form And Va 760 Instructions

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

Va Disability Pay Schedule 2022 Update Hill Ponton P A

2020 Va Disability Pay Chart Va Claims Insider

How To Create An Auto Loan Car Payment Calculator In Wordpress Check More At Https Www Latestblog Org How To C Car Payment Calculator Car Payment Car Loans

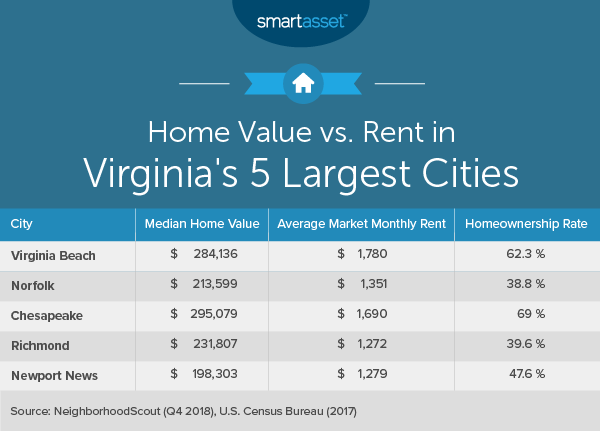

What Is The Cost Of Living In Virginia Smartasset

Pay Online Chesterfield County Va

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

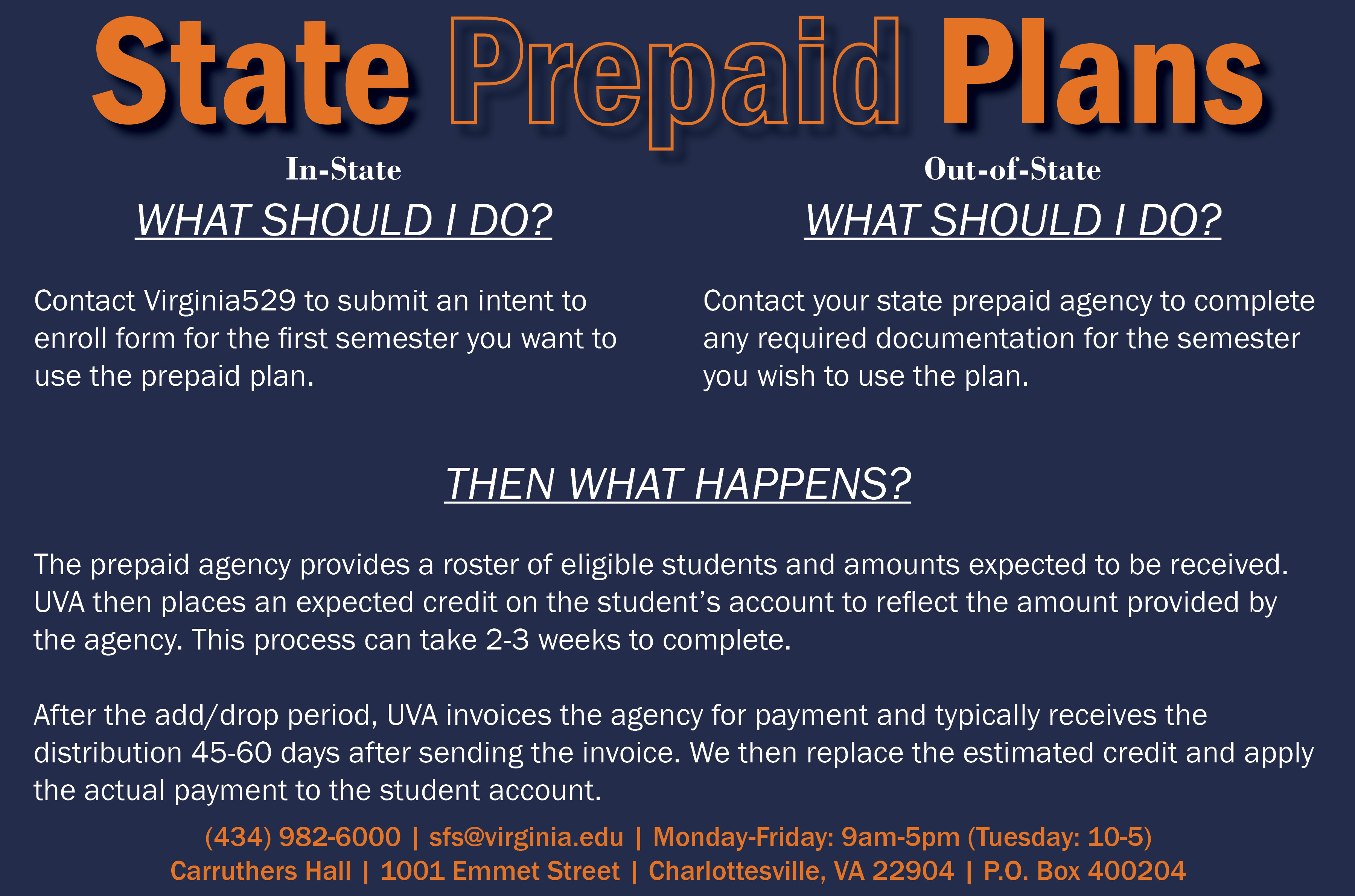

529 College Savings State Prepaid Tuition Programs Student Financial Services